|

Important Notes

|

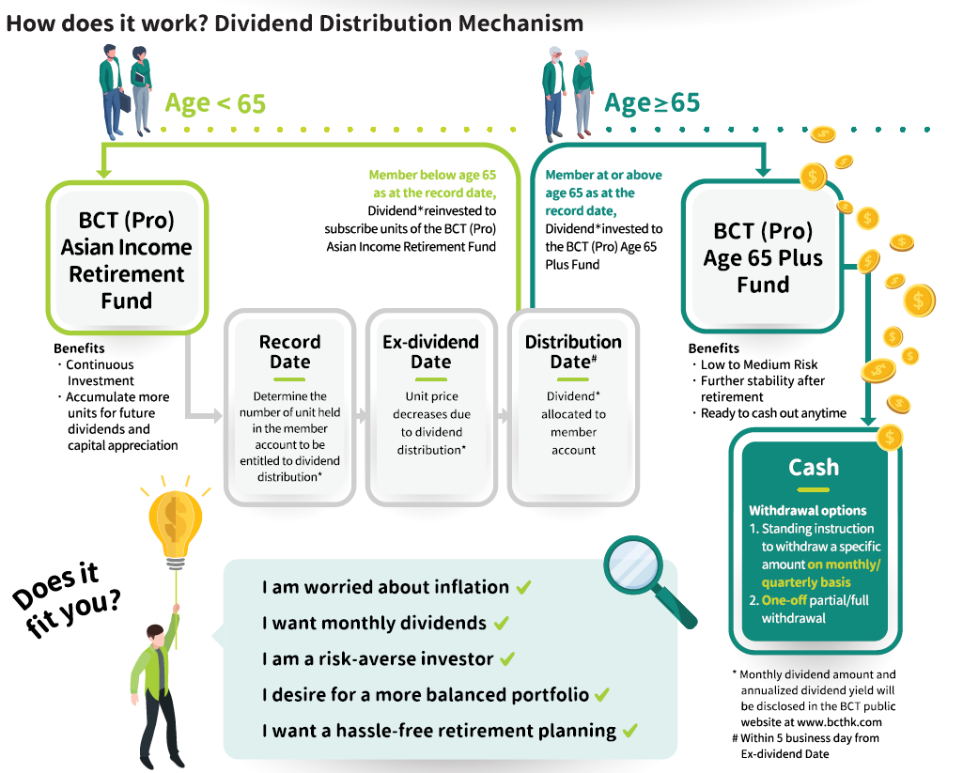

We are heading to an era of high inflation again, which affects the buying power of money and erodes the value of retirement savings. Hong Kong people are famous for their longevity, and we will be experiencing a period of inflation once more. In that sense, inflation is the enemy of retirement! BCT launches the first MPF fund which aims to provide "protection against inflation" as well as "dividend income" -Asian Income Retirement Fund. No matter which stage of life you are in, BCT is here to shape the future with you.

Terms and Conditions:

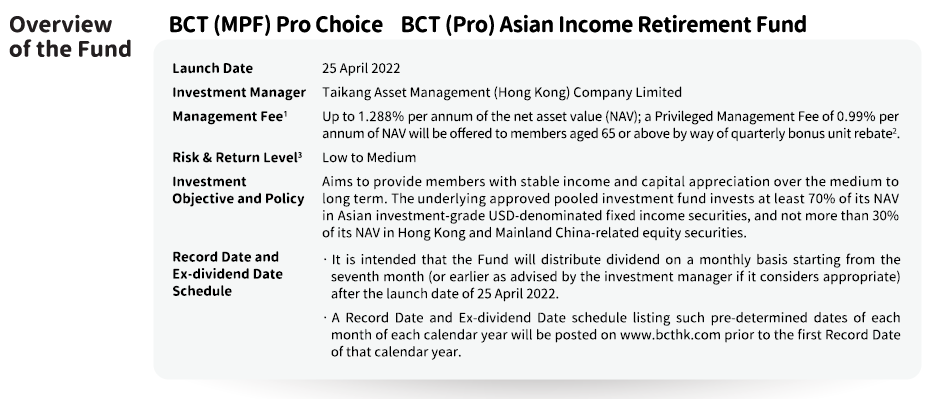

1. "Management Fee" include fees paid to the trustee, administrator, custodian, investment manager and sponsor of a scheme for providing their services to the relevant funds. They are usually charged as a percentage of the NAV of a fund.

2. The Privileged Management Fee is arrived at by applying bonus unit rebate to the Management Fee of the Fund. The calculation of Privileged Management Fee is shown as follows: “Privileged Management Fee = Management Fee – the rate of bonus unit rebate”. Bonus unit rebate is calculated on the basis of net asset value of the Fund held by the relevant member as at the end of each month. Bonus unit rebate will be credited to the relevant member account after the end of each quarter. If the relevant member terminates his/her relevant account or all assets in his/her relevant account have been transferred out before the end of the quarter, bonus unit rebate for that quarter will be forfeited. If the relevant member's account eligible to the Privileged Management Fee stated in this flyer is also entitled to any other special offer provided by BCT, the one with the highest rate of bonus unit rebate shall prevail. The offer of the Privileged Management Fee as stipulated in this flyer may be changed or withdrawn by BCT at its sole discretion upon its giving of one month’s prior notice. Such notice will be sent via the customer communication channel(s) as selected by BCT, including but not limited to customer website. In the event of any dispute as to the eligibility for and entitlement to the Privileged Management Fee or bonus unit rebate rate, BCT's decision shall be final and conclusive.

3.The Risk & Return Level for each constituent fund is assigned by BCT and subject to review at least annually. It is based on the corresponding constituent fund's volatility and expect return and categorized as "High", "Medium", "Low to Medium", and "Low". It is provided from reference only.