Leaflet and Useful Links

ONE

Investment Solution

Ready-made and low cost

Leaflet and Useful Links

If one or more of the specified fund switching instruction(s) is / are being processed on the annual date of de-risking, the annual de-risking will only take place on the next dealing day upon the completion of these instructions where necessary. You should note that the annual de-risking may be postponed as a result.

| Name of Notice | Target | Send Out Time |

|---|---|---|

| DIS Pre-Implementation Notice (“DPN”) & Important Note | All members | December 2016 to January 2017 |

| DIS Re-Investment Notice ("DRN") | Relevant members | 20 April 2017 |

Members who HAVE NOT given any investment instruction would receive the "DIS Re-investment Notice" ("DRN"). If the relevant members do not agree to accept the new arrangement, they need to opt-out by replying to BCT. If no reply is given within 42 days of the date of the "DIS Re-investment Notice", any MPF assets already accumulated, future contributions and MPFs transferred from another scheme in the future would be invested in accordance with the DIS.

Relevant members have until "Due Date" (i.e. 42 days after the date of the DRN) to give instruction in response to the DRN. If they want to stay invested in the original default fund, they must respond to the DRN through the following "authorized" channels, so that relevant instruction is received by us before the following cut-off times on the Due Date. Channels other than those set out below are not authorized for DIS purposes and submitting the instruction through unauthorized channels (e.g. via e-mail, intermediaries or bank branches) is generally not acceptable (although the trustee may, on a case basis, choose to accept and process such instruction based on the actual time of receipt by the trustee).

| Authorized Channels for DIS Purpose | Cut-off Time on the Due Date |

|---|---|

| By post / In person (for instruction given by way of the attached Option 2 Form) | 6:00 pm on the Due Date. Please make sure that sufficient time is allowed for postage (if applicable), so that the completed option 2 form can be received by Bank Consortium Trust Company Limited before the above cut-off time. |

| Fax (for instruction given by way of the attached Option 2 Form) | 23:59:59 pm on the Due Date |

| BCT website / BCT mobile apps (for instruction given via such website / apps) | 23:59:59 pm on the Due Date |

The Default Investment Strategy ("DIS") commenced on 1 April 2017. It is a ready-made and low cost investment strategy designed for MPF members who do not have time, or do not know how to make investment decisions. The DIS standardizes the default arrangements of the MPF schemes. In the new arrangement, the MPF benefits of members who do not give an investment instruction would be invested automatically according to the DIS. Members can also actively select the DIS or funds under the DIS if they find that the solution suits their own circumstances. You can know more about the key features of the DIS here.

Ready-made and low cost

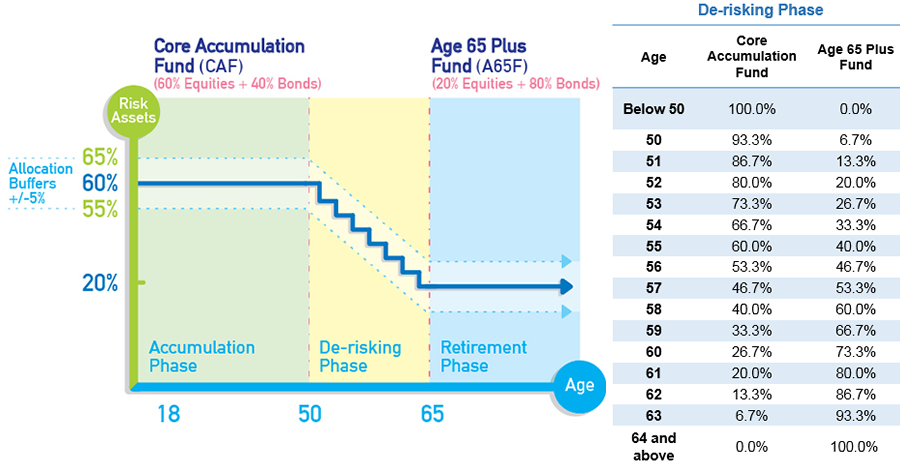

As an MPF member approaches retirement age, the investment strategy will be progressively adjusted to reduce the proportion of higher risk assets. The age-based de-risking will be generally carried out on members' birthday.

| Active Investment Option | De-risking Applies |

|---|---|

| DIS (the strategy) | |

| Core Accumulation Fund Age 65 Plus Fund |

To know more about the DIS, please refer to the notices, MPF Scheme Brochure and other materials at our Download Zone.

Allianz Global Investors Asia Pacific Limited ("Allianz Global Investors") is one of the world's leading active asset managers, operating across 23 locations worldwide, and with specialized in-house research teams around the globe. It has more than EUR673 billion in AUM for individuals, families and institutions worldwide and employ more than 700 investment professionals. (As at 31 Dec 2021)

Our mission is simple: through tailored solutions and a flexible and advisory approach, we seek to elevate our clients' experience of active asset management – as stated in our brand promise: "Value. Shared."

Source: Allianz Global Investors as at 31 Dec 2021.

Amundi, the leading European asset manager, ranking among the top 10 global players*, offers its 100 million clients - retail, institutional and corporate - a complete range of savings and investment solutions in active and passive management, in traditional or real assets.

With its six international investment hubs^, financial and extra-financial research capabilities and long-standing commitment to responsible investment, Amundi is a key player in the asset management landscape.

Amundi clients benefit from the expertise and advice of 4,800 employees in more than 35 countries. A subsidiary of the Crédit Agricole group and listed on the stock exchange, Amundi currently manages more than €2 trillion of assets#.

* Source: IPE "Top 500 Asset Managers" published in June 2021, based on assets under management as at 31/12/2020

^ Boston, Dublin, London, Milan, Paris and Tokyo

# Amundi data as at 31/03/2022

Fidelity International offers investment solutions and services and retirement expertise to more than 2.8 million customers globally. As a privately held, purpose-driven company with a 50-year heritage, we think generationally and invest for the long term. Operating in more than 25 locations, our clients range from central banks, sovereign wealth funds, large corporates, financial institutions, insurers and wealth managers, to private individuals.

Our Workplace & Personal Financial Health business provides individuals, advisers and employers with access to world-class investment choices, third-party solutions, administration services and pension guidance. Together with our Investment Solutions & Services business, we invest $574.9 billion on behalf of our clients. By combining our asset management expertise with our solutions for workplace and personal investing, we work together to build better financial futures.

Source: Fidelity, as at 31 March 2022.

Invesco Hong Kong Limited ("Invesco") is a global independent investment management firm dedicated to delivering an investment experience that helps people get more out of life. With more than 8,000 employees worldwide, we manage US$ 1.6 trillion of assets globally with an on-the-ground presence in more than 20 markets. (as of 31 December 31, 2021). Invesco was established in 1935. The firm is currently listed on the New York Stock Exchange under the symbol IVZ.

Invesco has been serving Hong Kong employers with their retirement needs since 1977. We have proven expertise in managing retirement assets for pensions schemes and understand the different needs of individuals when they invest for retirement. As an Invesco pension scheme member, you have access to a wide range of investment choices that align with your individual goals.

In Asia Pacific since 1962, Invesco is one of the most experienced investment firms in the region. Combining our regional investing expertise, Invesco provides well-established and world-class services to cater for the needs of retirement solutions locally.

Source: Invesco as at 31 Dec 2021.

With about US$2.51 trillion in assets under management (the Asset Management client funds of J.P. Morgan Chase & Co. as at 31 March 2022) and offices in over 30 countries around the world, J.P. Morgan Asset Management offers global coverage with a strong local market presence, and leadership positions in most asset classes.

In Asia Pacific we have 8 offices, including Hong Kong as our regional headquarters, Australia, China, India, Japan, Korea, Singapore and Taiwan. With over 2,469 employees across the region, J.P. Morgan Asset Management is able to provide a constant link to these markets and to gather first-hand insights and perspectives.

Source: J.P. Morgan Asset Management as at 31 March 2022.

As a global investment manager, Schroder PLC ("Schroders") helps institutions, intermediaries and individuals across the planet meet their goals, fulfil their ambitions, and prepare for the future. We are responsible for £731.6 billion (€871.3 billion/US$990.9 billion) of assets for our clients who trust us to deliver sustainable returns. We remain determined to build future prosperity for them, and for all of society. Today, we have 5,729 people across six continents who focus on doing just this.

We are a global business that's managed locally. This allows us to always keep our clients' needs at the heart of everything we do.

Source: Schroders as at 31 Dec 2021.

CSOP Asset Management Limited ("CSOP") was established in Hong Kong in January 2008 as the first offshore subsidiary established by one of the largest Chinese asset management companies with parent company total AUM of US$ 266 billion as of 31 December 2022. As a dedicated homegrown ETF issuer and Greater China investment solutions provider, CSOP is committed to serving investors such as sovereign wealth funds, pensions, insurance, and endowments globally. As of 31 December 2022, the total AUM of CSOP is over US$ 12.6 billion, making it the second largest ETF Issuer by AUM in Hong Kong.

Source: CSOP as at 31 December 2022.

Franklin Templeton's mission is to help clients achieve better outcomes through investment management expertise, wealth management and technology solutions.

Through its specialist investment managers, the Company brings extensive capabilities in equity, fixed income, alternatives and custom multi-asset solutions.

With employees in over 30 countries, including 1,300 investment professionals, the California-based Company has more than 70 years of investment experience and approximately $1.58 trillion in assets under management as of December 31, 2021.

*Source: Franklin Templeton Investments as at 31 Dec 2021.

China Life Insurance (Overseas) Company Limited ("China Life (Overseas)") is a wholly-owned subsidiary of China Life Insurance (Group) Company, China's largest state-owned financial insurance corporation. The Hong Kong branch was established in 1984, with a footprint in Hong Kong for over 35 years. The business of China Life (Overseas) covers life insurance and provident fund service. We aim to provide quality products and services to customers, including life insurance, endowment and annuity, critical illness and medical insurance, children's education plans, group insurance, high-net-worth life insurance solution and pension funds (Occupational Retirement Scheme and Mandatory Provident Fund).

Source: China Life (Overseas) as at 28 April 2022

Taikang Asset Management (Hong Kong) Company Limited (referred as "Taikang Asset (Hong Kong)"), a wholly-owned subsidiary of Taikang Asset Management Company Limited (referred as "Taikang Asset"), was established in November 2007. As of December 31, 2021, the size of total assets under management (referred as "AUM") of Taikang Asset has exceeded USD 433.67 billion, as one of the largest asset management company in China. The size of pension AUM has exceeded USD 100 billion, making Taikang Asset one of the largest pension manager in China.

Taikang Asset has extensive investment experience across multiple sectors and a wide range of asset classes, including fixed income, equities, offshore assets, infrastructure and real estate, stocks, and other financial instruments. Taikang Asset offers its investment products and services for includinge insurance asset management, pension fund management, enterprise annuities, occupational annuities, alternative project investments, wealth management, asset management, pension products, QDII separate accounts, and mutual funds. Taikang Asset has developed a client service infrastructure on the basis of client centricity and has faithfully implemented the service list assurances. The Company is committed to improving clients' investment experience through closed-loop client relationship management.

Source: Taikang Asset (Hong Kong), as at 31 December 2021