There are no articles in this category. If subcategories display on this page, they may contain articles.

Mandatory Contribution

| Contribution % Relevant Income (HK$) | Employer | Employee |

|---|---|---|

| Less than 7,100 / month or less than 85,200 / year | 5% | Nil |

| 7,100 - 30,000 / month or 85,200 - 360,000 / year | 5% | 5% |

| More than 30,000 / month or more than 360,000 / year | 1,500 / month | 1,500 / month |

Remittance Statement

When making contribution payments, you need to submit a remittance statement that states the contribution details of all your employees enrolled in the MPF scheme. Please download the remittance statement templates through the following links:

We understand that the monthly contribution process can be time consuming. To make the process easier, BCT provides several options, including free softwares & Autobill to employers. Should you need any assistance, please feel free to contact our representative through our Employer Hotline at 2298 9388.

C-Online

C-Online is a safe, online contribution system designed for employers. It allows you to submit remittance statements instantly and generate pay records. Advantages of using the C-Online include round-the-clock service, payment security and data privacy.

BCT MPF Calculator (For Regular Employee)

The BCT MPF calculator is used within Microsoft Excel to help you prepare remittance statements and pay records, and keep track of contribution payment history. Click here for a demonstration.

Autobill

- A new employer may select Autobill service via the Application Form – Employer [FORM : AP (ER)] or the Information Update Form (For Participating Employer [FORM : IU (ER)] for an existing employer.

- This service is Only applicable for employers under the following payroll conditions:

- Monthly payroll cycle

- Payroll period end date at end of the month

- After the setup of the Autobill service, we will send the remittance statement to the employer around 25th day of each month based on the updated relevant income of employees who have been enrolled to the MPF Scheme.

- If there is any new employee joining the MPF scheme or there is relevant income update, employer is required to send the Employee Enrollment Notice [FORM : EEN (ER)] to us in order to capture the updated information on the remittance statement.

- Employer is reminded to send back the signed remittance statement together with contribution payment to us on or before the contribution day.

Flexi2

Flexi2 is a standalone application on Windows platform that can provided human resources management functions in addition to MPF contributions calculation.

- Comprehensive management system

- Support MPF scheme and ORSO plan

- With MPF / ORSO contribution calculation, payroll management and leave management functions

- Taxation and reporting module

MPF Contribution Authorized Channels

Employer and self-employed persons must make MPF contributions through the following channels. The “Designated Banks” mentioned below refer to Chong Hing Bank, CMB Wing Lung Bank, Dah Sing Bank, Fubon Bank, ICBC (Asia), OCBC Bank, Public Bank and Shanghai Commercial Bank

| Contribution Payment Methods | Cut-off Time | |

|---|---|---|

| 1 | Direct Debit Authorisation (DDA)

The contributions will be debited directly from the employer’s “Designated Banks” account upon verification of the remittance statement by Bank Consortium Trust Company Limited. Self-employed persons may also make contributions through DDA and the contributions will be debited directly from their personal bank accounts. When the DDA service becomes effective, the contributions will be debited directly from the “Designated Banks” accounts on the contribution day. The service is applicable to monthly or yearly contributions. The default debit date is the last day of each contribution period. Please make contributions through other channels or methods before the DDA is set up. Please consult your bank for the applicable charges. |

Send the remittance statement to Bank Consortium Trust Company Limited or “Designated Banks” on or before the contribution day. |

| 2 | Internet Banking Bill Payment Service

You may make contributions through internet banking services. Please select “Insurance or Pension Services” from the merchant list and select “BCT (MPF) Pro Choice” or “BCT (MPF) Industry Choice”. Please consult your bank for the scope of services. |

On or before the contribution day. Please consult your bank for the cutoff time. |

| 3 | PPS

You may make contributions through PPS: Please call 18011, or visit www.ppshk.com BCT Merchant Code:BCT (MPF) Pro Choice: 6289 BCT (MPF) Industry Choice: 6291 |

On or before the contribution day. Please note the cut-off time of PPS and the processing time (it may take one to two days, excluding Saturdays, Sundays and public holidays). |

| 4 | Direct Deposit

You may make contributions by cash, cheque or bank transfer at the branch teller counters of “Designated Banks” during the office hours. Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing Besides, self-employed persons should provide their participating plan numbers at the teller counter of “Designated Banks” branches, while employers should provide the remittance statements at the same time; if a remittance statement is not available, their participating plan numbers. |

On or before the contribution day. Please consult “Designated Banks” for the cut-off time. |

| 5 | Cheque Drop-in Box of “Designated Banks”◆

i) Employers please drop the cheques being attached to remittance statements ii) Self-employed persons please drop the cheques with participation plan number written into the cheque drop-in box at any branch of “Designated Banks”◆ Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited - Client A/C - Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited - Client A/C - Industry Clearing ◆ Applicable to Chong Hing Bank, CMB Wing Lung Bank, Fubon Bank, ICBC (Asia), Public Bank and Shanghai Commercial Bank only. |

On or before the contribution day. Please consult “Designated Banks”◆ for the cut-off time. |

| 6 | Direct Deposit through Internet Banking of “Designated Banks”*

You may transfer the contributions to the account of BCT (MPF) Pro Choice or BCT (MPF) Industry Choice through internet banking service of “Designated Banks”*. Please consult “Designated Banks”* for the scope of services * Applicable to NET Banking of CMB Wing Lung Bank, DS-Direct Services and 328 Business e-Banking of Dah Sing Bank and Internet Banking of Shanghai Commercial Bank only. |

On or before the contribution day. Please consult “Designated Banks” for the cut-off time. |

| 7 | By Post (Making Crossed Cheque Payable to Bank Consortium Trust Company Limited)

You may send the remittance statements and / or crossed cheques (post-dated cheque will be not accepted) by post to Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong. Please make a crossed cheque payable to: i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing |

Please make sure that there is sufficient time for postage (particularly during seasonal pressure periods) and that the contributions and remittance statements can be received by Bank Consortium Trust Company Limited on or before the contribution day. The delivery time may vary between the post offices located in different regions. |

| 8 | E-Cheque

1. Please send the e-cheque and the remittance statements / contribution files, if applicable, to the designated email account: echeque@bcthk.com or upload by logging into BCT Employer Website www.bcthk.com. 2. Employers and self-employed persons should provide their participating plan numbers at the field of “remarks” in the e-cheque. 3. Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing |

On or before the contribution day. (Daily cut-off time: 23:59 (as per BCT system record)) |

| 9 | In Person

You may deliver the remittance statements and / or crossed cheques in person to Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong during the office hours. Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing Office hours: Monday to Friday 9:00am to 6:00pm (Except public holiday) |

On or before the contribution day. |

For printable version of the contribution payment method, please click here.

Employers’ tools for preparing the remittance statement

| Tools | Regular Employee | Casual Employee |

|---|---|---|

| “C-Online” online contribution system | ||

| “Flexi2” software | ||

| BCT MPF Calculator | ||

| Remittance Statement |

Employers must submit the remittance statement of BCT (MPF) Pro Choice and BCT (MPF) Industry Choice through the following channels or methods:

Please consult individual designated bank and your bank for the scope of services.

| Submission of remittance statement | |

|---|---|

| 1 | C-Online△

C-Online is an online contribution system specially designed for employers who use calendar month as payroll cycle (cycle starts from the first day of the month and ends on the last day of the month), and can generate and submit remittance statements instantly through BCT Employer Website. △ Not applicable to casual employees |

| 2 | Flexi2△

Flexi2 is a tailor-made software for employers to manage the employee records, prepare the remittance statements, administer payroll, and prepare pay records and employee tax returns. Employers may also submit contribution data files (FPE File) through BCT Employer Website, and via “Designated Banks”. Please refer to the sections of BCT Employer Website, Internet Banking of “Designated Banks” or consult “Designated Banks” for scope of services in receiving Flexi2 contribution data files. △ Not applicable to casual employees |

| 3 | BCT Employer Website

Employer may submit the remittance statements via BCT employer website (files can be in various electronic formats). Please follow the steps below to upload the related file: Step 1: Go to our website, login to our employer website from “Your Online Account” Step 2: Upload the related file at “Contribution Data Submission”. |

| 4 | By Post to Bank Consortium Trust Company Limited

Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong. |

| 5 | Branch Teller Counters of “Designated Banks”

Employers may submit the remittance statements together with the contributions in cash, cheque or by bank account transfer, at the branch teller counters of the “Designated Banks” Please consult “Designated Banks” on the cut-off time. |

| 6 | Cheque Drop-in Boxes of “Designated Banks”#

Employers may drop remittance statements with cheque attached in the cheque drop-in boxes# at the branches of “Designated Banks”#. Please do not drop remittance statements without cheque attached and other documents into cheque drop-in box. # Applicable to Chong Hing Bank, CMB Wing Lung Bank, Fubon Bank, ICBC (Asia), Public Bank and Shanghai Commercial Bank only. Please consult “Designated Banks”# for the cut-off time. |

| 7 | Internet Banking Service of “Designated Banks”▲

Employers may upload the Flexi2 contribution data files through the internet banking services▲ of the “Designated Banks”▲ ▲ Applicable to NET Banking of CMB Wing Lung Bank, DS-Direct Services and 328 Business e-Banking of Dah Sing Bank and Internet Banking of Shanghai Commercial Bank only. Please consult the above banks on cut-off time and scope of services. |

| 8 | In Person

Employers may submit the remittance statements in person to Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong during the office hours. Office hours: Monday to Friday 9:00am to 6:00pm (Except public holiday) |

Note:

For employers who subscribed the Autobill service, please note that the document you receive monthly from BCT is the remittance statement.

Contribution Receipt

A contribution receipt together with payment details of individual employees will be sent to you for your record.

Pay Record

Under the MPF legislation, you are required to provide pay records to your employees.

Regular Employee - within seven working days after making contribution payment to us.

*Servicing banks include, Chong Hing Bank, CMB Wing Lung Bank, Dah Sing Bank, Fubon Bank, ICBC (Asia), OCBC Bank, Public Bank (Hong Kong) and Shanghai Commercial Bank

How to Calculate First Contributions?

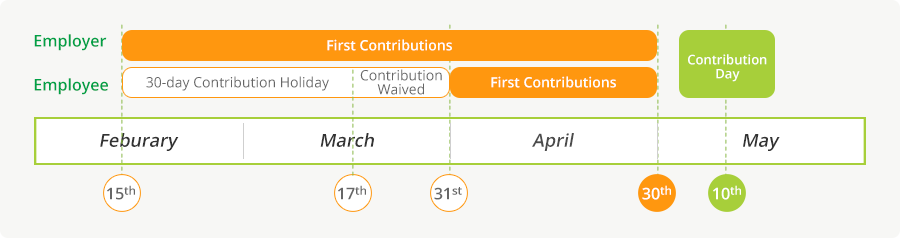

Regular Employee

The first contributions for new employees are to be made on or before the 10th day of the calendar month following the end of the 60th day of employment.

- Your contributions are calculated from the 1st day of the employees’ employment.

- Your employees are entitled to a “30-day contribution holiday” and their contributions are calculated from the 31st day of employment. However, the first incomplete payroll cycle (for monthly payroll cycles or payroll cycles more frequent than monthly) or calendar month (for payroll cycles less frequent than monthly) immediately following the 30-day contribution holiday is also waived.

helps you calculate on first contribution.

Example:

- The 1st day of employment is 15th February.

- The payroll cycle is monthly.

The MPF First Contribution Calculator helps you calculate the first contributions.

Mandatory Contribution

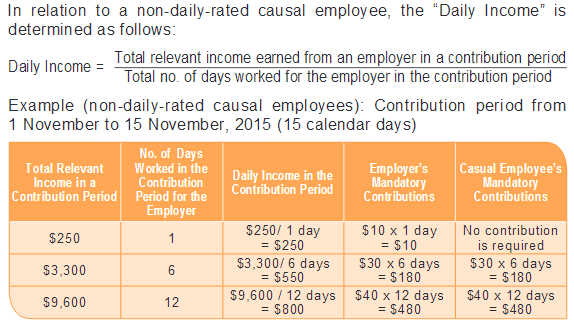

Daily Rated Casual Employee

| Amount of mandatory contributions (per working day) | ||

| Daily Income (HK$) | Employer's contributions (HK$) | Employee's contributions (HK$) |

|---|---|---|

| Less than 280 | 10 | Not required |

| 280 to less than 350 | 15 | 15 |

| 350 to less than 450 | 20 | 20 |

| 450 to less than 550 | 25 | 25 |

| 550 to less than 650 | 30 | 30 |

| 650 to less than 750 | 35 | 35 |

| 750 to less than 850 | 40 | 40 |

| 850 to less than 950 | 45 | 45 |

| 950 or more | 50 | 50 |

Remittance Statement

When making contribution payments, you need to submit a remittance statement that states the contribution details of all your employees enrolled in the MPF scheme. Please click here to download the remittance statement template.

We understand that the monthly contribution process can be time consuming. To make the process easier, BCT provides several options to facilitate you to manage your remittance statement. Should you need any assistance, please feel free to contact our representative through our Employer Hotline at 2298 9388.

BCT MPF Calculator (For Casual Employee)

This calculator (to be used with Microsoft Excel) is designed to help you prepare remittance statements (applicable to contribution payments within 10 days after the contribution period). Click here to learn more.

Employer Contribution Forms (For Casual Employee)

Ready made pre-printed forms (applicable to contribution payments on or before the next working day (excluding Saturdays) following the payment of relevant income to employees).

MPF Contribution Authorized Channels

Employer and self-employed persons must make MPF contributions through the following channels. The “Designated Banks” mentioned below refer to Chong Hing Bank, CMB Wing Lung Bank, Dah Sing Bank, Fubon Bank, ICBC (Asia), OCBC Bank, Public Bank and Shanghai Commercial Bank.

| Contribution Payment Methods | Cut-off Time | |

|---|---|---|

| 1 | Direct Debit Authorisation (DDA)

The contributions will be debited directly from the employer’s “Designated Banks” account upon verification of the remittance statement by Bank Consortium Trust Company Limited. Self-employed persons may also make contributions through DDA and the contributions will be debited directly from their personal bank accounts. When the DDA service becomes effective, the contributions will be debited directly from the “Designated Banks” accounts on the contribution day. The service is applicable to monthly or yearly contributions. The default debit date is the last day of each contribution period. Please make contributions through other channels or methods before the DDA is set up. Please consult your bank for the applicable charges. |

Send the remittance statement to Bank Consortium Trust Company Limited or “Designated Banks” on or before the contribution day. |

| 2 | Internet Banking Bill Payment Service

You may make contributions through internet banking services. Please select “Insurance or Pension Services” from the merchant list and select “BCT (MPF) Pro Choice” or “BCT (MPF) Industry Choice”. Please consult your bank for the scope of services. |

On or before the contribution day. Please consult your bank for the cutoff time. |

| 3 | PPS

You may make contributions through PPS: Please call 18011, or visit www.ppshk.com BCT Merchant Code:BCT (MPF) Pro Choice: 6289 BCT (MPF) Industry Choice: 6291 |

On or before the contribution day. Please note the cut-off time of PPS and the processing time (it may take one to two days, excluding Saturdays, Sundays and public holidays). |

| 4 | Direct Deposit

You may make contributions by cash, cheque or bank transfer at the branch teller counters of “Designated Banks” during the office hours. Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing Besides, self-employed persons should provide their participating plan numbers at the teller counter of “Designated Banks” branches, while employers should provide the remittance statements at the same time; if a remittance statement is not available, their participating plan numbers. |

On or before the contribution day. Please consult “Designated Banks” for the cut-off time. |

| 5 | Cheque Drop-in Box of “Designated Banks”◆

i) Employers please drop the cheques being attached to remittance statements ii) Self-employed persons please drop the cheques with participation plan number written into the cheque drop-in box at any branch of “Designated Banks”◆ Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited - Client A/C - Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited - Client A/C - Industry Clearing ◆ Applicable to Chong Hing Bank, CMB Wing Lung Bank, Fubon Bank, ICBC (Asia), Public Bank and Shanghai Commercial Bank only. |

On or before the contribution day. Please consult “Designated Banks”◆ for the cut-off time. |

| 6 | Direct Deposit through Internet Banking of “Designated Banks”*

You may transfer the contributions to the account of BCT (MPF) Pro Choice or BCT (MPF) Industry Choice through internet banking service of “Designated Banks”*. Please consult “Designated Banks”* for the scope of services * Applicable to NET Banking of CMB Wing Lung Bank, DS-Direct Services and 328 Business e-Banking of Dah Sing Bank and Internet Banking of Shanghai Commercial Bank only. |

On or before the contribution day. Please consult “Designated Banks” for the cut-off time. |

| 7 | By Post (Making Crossed Cheque Payable to Bank Consortium Trust Company Limited)

You may send the remittance statements and / or crossed cheques (post-dated cheque will be not accepted) by post to Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong. Please make a crossed cheque payable to: i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing |

Please make sure that there is sufficient time for postage (particularly during seasonal pressure periods) and that the contributions and remittance statements can be received by Bank Consortium Trust Company Limited on or before the contribution day. The delivery time may vary between the post offices located in different regions. |

| 8 | E-Cheque

1. Please send the e-cheque and the remittance statements / contribution files, if applicable, to the designated email account: echeque@bcthk.com or upload by logging into BCT Employer Website www.bcthk.com. 2. Employers and self-employed persons should provide their participating plan numbers at the field of “remarks” in the e-cheque. 3. Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing |

On or before the contribution day. (Daily cut-off time: 23:59 (as per BCT system record)) |

| 9 | In Person

You may deliver the remittance statements and / or crossed cheques in person to Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong during the office hours. Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing Office hours: Monday to Friday 9:00am to 6:00pm (Except public holiday) |

On or before the contribution day. |

For printable version of the contribution payment method, please click here.

Employers’ tools for preparing the remittance statement

| Tools | Regular Employee | Casual Employee |

|---|---|---|

| “C-Online” online contribution system | ||

| “Flexi2” software | ||

| BCT MPF Calculator | ||

| Remittance Statement |

Employers must submit the remittance statement of BCT (MPF) Pro Choice and BCT (MPF) Industry Choice through the following channels or methods:

Please consult individual designated bank and your bank for the scope of services.

| Submission of remittance statement | |

|---|---|

| 1 | C-Online△

C-Online is an online contribution system specially designed for employers who use calendar month as payroll cycle (cycle starts from the first day of the month and ends on the last day of the month), and can generate and submit remittance statements instantly through BCT Employer Website. △ Not applicable to casual employees |

| 2 | Flexi2△

Flexi2 is a tailor-made software for employers to manage the employee records, prepare the remittance statements, administer payroll, and prepare pay records and employee tax returns. Employers may also submit contribution data files (FPE File) through BCT Employer Website, and via “Designated Banks”. Please refer to the sections of BCT Employer Website, Internet Banking of “Designated Banks” or consult “Designated Banks” for scope of services in receiving Flexi2 contribution data files. △ Not applicable to casual employees |

| 3 | BCT Employer Website

Employer may submit the remittance statements via BCT employer website (files can be in various electronic formats). Please follow the steps below to upload the related file: Step 1: Go to our website, login to our employer website from “Your Online Account” Step 2: Upload the related file at “Contribution Data Submission”. |

| 4 | By Post to Bank Consortium Trust Company Limited

Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong. |

| 5 | Branch Teller Counters of “Designated Banks”

Employers may submit the remittance statements together with the contributions in cash, cheque or by bank account transfer, at the branch teller counters of the “Designated Banks” Please consult “Designated Banks” on the cut-off time. |

| 6 | Cheque Drop-in Boxes of “Designated Banks”#

Employers may drop remittance statements with cheque attached in the cheque drop-in boxes# at the branches of “Designated Banks”#. Please do not drop remittance statements without cheque attached and other documents into cheque drop-in box. # Applicable to Chong Hing Bank, CMB Wing Lung Bank, Fubon Bank, ICBC (Asia), Public Bank and Shanghai Commercial Bank only. Please consult “Designated Banks”# for the cut-off time. |

| 7 | Internet Banking Service of “Designated Banks”▲

Employers may upload the Flexi2 contribution data files through the internet banking services▲ of the “Designated Banks”▲ ▲ Applicable to NET Banking of CMB Wing Lung Bank, DS-Direct Services and 328 Business e-Banking of Dah Sing Bank and Internet Banking of Shanghai Commercial Bank only. Please consult the above banks on cut-off time and scope of services. |

| 8 | In Person

Employers may submit the remittance statements in person to Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong during the office hours. Office hours: Monday to Friday 9:00am to 6:00pm (Except public holiday) |

Note:

For employers who subscribed the Autobill service, please note that the document you receive monthly from BCT is the remittance statement.

Contribution Receipt

A contribution receipt together with payment details of individual employees will be sent to you for your record.

Pay Record

Casual Employee - within seven working days after making contribution payment to us if you choose to make contribution payment within 10 days after the contribution period**

**Pay record is not required if you choose to make contribution payments on or before the next working day (excluding Saturday) following the payment of relevant income to employees.

How to Calculate First Contributions?

Casual Employee

Both you and your casual employee’s contributions are to start from the 1st day of employment.

Please click here for more details

MPF Contribution Designated Channels

Employer and self-employed persons must make MPF contributions through the following channels. The “Designated Banks” mentioned below refer to Chong Hing Bank, CMB Wing Lung Bank, Dah Sing Bank, Fubon Bank, ICBC (Asia), OCBC Bank, Public Bank and Shanghai Commercial Bank

| Contribution Payment Methods | Cut-off Time | |

|---|---|---|

| 1 | Direct Debit Authorisation (DDA)

The contributions will be debited directly from the employer’s “Designated Banks” account upon verification of the remittance statement by Bank Consortium Trust Company Limited. Self-employed persons may also make contributions through DDA and the contributions will be debited directly from their personal bank accounts. When the DDA service becomes effective, the contributions will be debited directly from the “Designated Banks” accounts on the contribution day. The service is applicable to monthly or yearly contributions. The default debit date is the last day of each contribution period. Please make contributions through other channels or methods before the DDA is set up. Please consult your bank for the applicable charges. |

Send the remittance statement to Bank Consortium Trust Company Limited or “Designated Banks” on or before the contribution day. |

| 2 | Internet Banking Bill Payment Service

You may make contributions through internet banking services. Please select “Insurance or Pension Services” from the merchant list and select “BCT (MPF) Pro Choice” or “BCT (MPF) Industry Choice”. Please consult your bank for the scope of services. |

On or before the contribution day. Please consult your bank for the cutoff time. |

| 3 | PPS

You may make contributions through PPS: Please call 18011, or visit www.ppshk.com BCT Merchant Code:BCT (MPF) Pro Choice: 6289 BCT (MPF) Industry Choice: 6291 |

On or before the contribution day. Please note the cut-off time of PPS and the processing time (it may take one to two days, excluding Saturdays, Sundays and public holidays). |

| 4 | Direct Deposit

You may make contributions by cash, cheque or bank transfer at the branch teller counters of “Designated Banks” during the office hours. Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing Besides, self-employed persons should provide their participating plan numbers at the teller counter of “Designated Banks” branches, while employers should provide the remittance statements at the same time; if a remittance statement is not available, their participating plan numbers. |

On or before the contribution day. Please consult “Designated Banks” for the cut-off time. |

| 5 | Cheque Drop-in Box of “Designated Banks”◆

i) Employers please drop the cheques being attached to remittance statements ii) Self-employed persons please drop the cheques with participation plan number written into the cheque drop-in box at any branch of “Designated Banks”◆ Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited - Client A/C - Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited - Client A/C - Industry Clearing ◆ Applicable to Chong Hing Bank, CMB Wing Lung Bank, Fubon Bank, ICBC (Asia), Public Bank and Shanghai Commercial Bank only. |

On or before the contribution day. Please consult “Designated Banks”◆ for the cut-off time. |

| 6 | Direct Deposit through Internet Banking of “Designated Banks”*

You may transfer the contributions to the account of BCT (MPF) Pro Choice or BCT (MPF) Industry Choice through internet banking service of “Designated Banks”*. Please consult “Designated Banks”* for the scope of services * Applicable to NET Banking of CMB Wing Lung Bank, DS-Direct Services and 328 Business e-Banking of Dah Sing Bank and Internet Banking of Shanghai Commercial Bank only. |

On or before the contribution day. Please consult “Designated Banks” for the cut-off time. |

| 7 | By Post (Making Crossed Cheque Payable to Bank Consortium Trust Company Limited)

You may send the remittance statements and / or crossed cheques (post-dated cheque will be not accepted) by post to Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong. Please make a crossed cheque payable to: i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing |

Please make sure that there is sufficient time for postage (particularly during seasonal pressure periods) and that the contributions and remittance statements can be received by Bank Consortium Trust Company Limited on or before the contribution day. The delivery time may vary between the post offices located in different regions. |

| 8 | E-Cheque

1. Please send the e-cheque and the remittance statements / contribution files, if applicable, to the designated email account: echeque@bcthk.com or upload by logging into BCT Employer Website www.bcthk.com. 2. Employers and self-employed persons should provide their participating plan numbers at the field of “remarks” in the e-cheque. 3. Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing |

On or before the contribution day. (Daily cut-off time: 23:59 (as per BCT system record)) |

| 9 | In Person

You may deliver the remittance statements and / or crossed cheques in person to Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong during the office hours. Please make a crossed cheque payable to (post-dated cheque will not be accepted): i) BCT (MPF) Pro Choice: Bank Consortium Trust Company Limited — Client A/C — Master Clearing ii) BCT (MPF) Industry Choice: Bank Consortium Trust Company Limited — Client A/C — Industry Clearing Office hours: Monday to Friday 9:00am to 6:00pm (Except public holiday) |

On or before the contribution day. |

For printable version of the contribution payment method, please click here.

Employers’ tools for preparing the remittance statement

| Tools | Regular Employee | Casual Employee |

|---|---|---|

| “C-Online” online contribution system | ||

| “Flexi2” software | ||

| BCT MPF Calculator | ||

| Remittance Statement |

Employers may submit the remittance statement of BCT (MPF) Pro Choice and BCT (MPF) Industry Choice through the following channels or methods:

Please consult individual designated bank and your bank for the scope of services.

| Submission of remittance statement | |

|---|---|

| 1 | C-Online△

C-Online is an online contribution system specially designed for employers who use calendar month as payroll cycle (cycle starts from the first day of the month and ends on the last day of the month), and can generate and submit remittance statements instantly through BCT Employer Website. △ Not applicable to casual employees |

| 2 | Flexi2△

Flexi2 is a tailor-made software for employers to manage the employee records, prepare the remittance statements, administer payroll, and prepare pay records and employee tax returns. Employers may also submit contribution data files (FPE File) through BCT Employer Website, and via “Designated Banks”. Please refer to the sections of BCT Employer Website, Internet Banking of “Designated Banks” or consult “Designated Banks” for scope of services in receiving Flexi2 contribution data files. △ Not applicable to casual employees |

| 3 | BCT Employer Website

Employer may submit the remittance statements via BCT employer website (files can be in various electronic formats). Please follow the steps below to upload the related file: Step 1: Go to our website, login to our employer website from “Your Online Account” Step 2: Upload the related file at “Contribution Data Submission”. |

| 4 | By Post to Bank Consortium Trust Company Limited

Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong. |

| 5 | Branch Teller Counters of “Designated Banks”

Employers may submit the remittance statements together with the contributions in cash, cheque or by bank account transfer, at the branch teller counters of the “Designated Banks” Please consult “Designated Banks” on the cut-off time. |

| 6 | Cheque Drop-in Boxes of “Designated Banks”#

Employers may drop remittance statements with cheque attached in the cheque drop-in boxes# at the branches of “Designated Banks”#. Please do not drop remittance statements without cheque attached and other documents into cheque drop-in box. # Applicable to Chong Hing Bank, CMB Wing Lung Bank, Fubon Bank, ICBC (Asia), Public Bank and Shanghai Commercial Bank only. Please consult “Designated Banks”# for the cut-off time. |

| 7 | Internet Banking Service of “Designated Banks”▲

Employers may upload the Flexi2 contribution data files through the internet banking services▲ of the “Designated Banks”▲ ▲ Applicable to NET Banking of CMB Wing Lung Bank, DS-Direct Services and 328 Business e-Banking of Dah Sing Bank and Internet Banking of Shanghai Commercial Bank only. Please consult the above banks on cut-off time and scope of services. |

| 8 | In Person

Employers may submit the remittance statements in person to Bank Consortium Trust Company Limited, 18/F Cosco Tower, 183 Queen’s Road Central, Hong Kong during the office hours. Office hours: Monday to Friday 9:00am to 6:00pm (Except public holiday) |

Note:

For employers who subscribed the Autobill service, please note that the document you receive monthly from BCT is the remittance statement.

Contribution Receipt

A contribution receipt together with payment details of individual employees will be sent to you for your record.