Leaflet and Useful Links

ONE

Investment Solution

Ready-made and low cost

Leaflet and Useful Links

If one or more of the specified fund switching instruction(s) is / are being processed on the annual date of de-risking, the annual de-risking will only take place on the next dealing day upon the completion of these instructions where necessary. You should note that the annual de-risking may be postponed as a result.

| Name of Notice | Target | Send Out Time |

|---|---|---|

| DIS Pre-Implementation Notice (“DPN”) & Important Note | All members | December 2016 to January 2017 |

| DIS Re-Investment Notice ("DRN") | Relevant members | 20 April 2017 |

Members who HAVE NOT given any investment instruction would receive the "DIS Re-investment Notice" ("DRN"). If the relevant members do not agree to accept the new arrangement, they need to opt-out by replying to BCT. If no reply is given within 42 days of the date of the "DIS Re-investment Notice", any MPF assets already accumulated, future contributions and MPFs transferred from another scheme in the future would be invested in accordance with the DIS.

Relevant members have until "Due Date" (i.e. 42 days after the date of the DRN) to give instruction in response to the DRN. If they want to stay invested in the original default fund, they must respond to the DRN through the following "authorized" channels, so that relevant instruction is received by us before the following cut-off times on the Due Date. Channels other than those set out below are not authorized for DIS purposes and submitting the instruction through unauthorized channels (e.g. via e-mail, intermediaries or bank branches) is generally not acceptable (although the trustee may, on a case basis, choose to accept and process such instruction based on the actual time of receipt by the trustee).

| Authorized Channels for DIS Purpose | Cut-off Time on the Due Date |

|---|---|

| By post / In person (for instruction given by way of the attached Option 2 Form) | 6:00 pm on the Due Date. Please make sure that sufficient time is allowed for postage (if applicable), so that the completed option 2 form can be received by Bank Consortium Trust Company Limited before the above cut-off time. |

| Fax (for instruction given by way of the attached Option 2 Form) | 23:59:59 pm on the Due Date |

| BCT website / BCT mobile apps (for instruction given via such website / apps) | 23:59:59 pm on the Due Date |

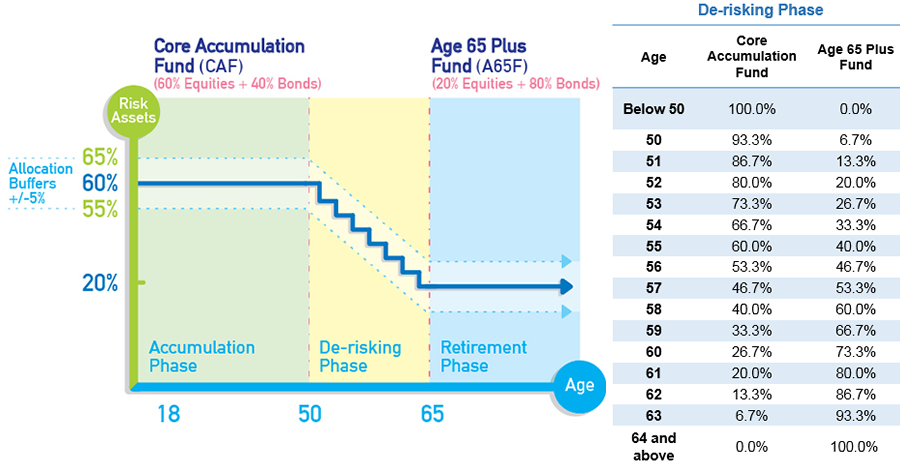

The Default Investment Strategy ("DIS") commenced on 1 April 2017. It is a ready-made and low cost investment strategy designed for MPF members who do not have time, or do not know how to make investment decisions. The DIS standardizes the default arrangements of the MPF schemes. In the new arrangement, the MPF benefits of members who do not give an investment instruction would be invested automatically according to the DIS. Members can also actively select the DIS or funds under the DIS if they find that the solution suits their own circumstances. You can know more about the key features of the DIS here.

Ready-made and low cost

As an MPF member approaches retirement age, the investment strategy will be progressively adjusted to reduce the proportion of higher risk assets. The age-based de-risking will be generally carried out on members' birthday.

| Active Investment Option | De-risking Applies |

|---|---|

| DIS (the strategy) | |

| Core Accumulation Fund Age 65 Plus Fund |

To know more about the DIS, please refer to the notices, MPF Scheme Brochure and other materials at our Download Zone.

Diversified constituent fund choices are important because different life stages, risk tolerance levels and financial situations require different types of portfolios in order to achieve your retirement goals.

How can BCT help? ReplayOur MPF schemes offer constituent funds managed by different investment managers that are not affiliated with the BCT Group. This enables us to independently appoint investment managers with diverse investment styles and philosophies to be used in our schemes. For further details, please refer to the latest principal brochure. As of today, 8 fund managers have been engaged to help managing your MPF. Overall speaking, the use of multiple fund managers allows us to focus on, among others, the service quality of the fund managers through our selection and monitoring process and provides us with the flexibility to replace fund managers independently.

^ BCT offers 2 MPF schemes, namely, BCT MPF (Pro) Choice and BCT (MPF) Industry Choice which offer a wide range of constituent funds.

BCT (MPF) Pro Choice has 5 constituent fund categories which provides 23 constituent funds covering a wide spectrum of risk.

Target Date Mixed Asset Funds - We are one of the first MPF providers to launch the SaveEasy Fund Series. The SaveEasy Funds are designed to shift their underlying investments from equities towards a greater exposure to bonds and cash as the relevant SaveEasy Fund gets closer to its particular target year. Please refer to Principal Brochure for more details.

In addition, our Equity Funds - Market Tracking Series consists of three constituent funds. Each constituent fund invests in one or more "Index Tracking Collective Investment Scheme (ITCIS)". All three constituent funds under this series are classified as "Low Fee Fund" (Fund Expense Ratio ≤1.3% or Management Fee ≤1%) as defined by the MPFA.

BCT (MPF) Industry Choice has 3 constituent fund categories which provides 12 constituent funds covering a wide spectrum of risk.

BCT (MPF) Industry Choice is created specifically for those working in the catering and construction industries.

A stable and consistent investment return can help members accumulate and grow their MPF asset for a quality retirement life.

How can BCT help? ReplayBCT engages different fund managers and selects the most appropriate fund manager(s) for each asset class based on their expertise and a set of criteria.

HKIFA website: http://www.hkifa.org.hk/eng/Fund-Performance-MPF.aspx

Fees directly affect investment returns. It is an important factor to consider when making fund choices.

How can BCT help? ReplayBCT reviews the operating efficiency of its constituent funds on an ongoing basis and sets our fees at an appropriate level with an aim to deliver value for our members.

Management fees of constituent funds range from 0.75% - 1.50% per annum of net asset value.

More Info BCT (MPF) Industry ChoiceManagement fees of constituent funds range from 0.75% - 1.6% per annum of net asset value.

More InfoGeneral Personal Accounts

For Personal Accounts except members who have retired, we offer special management fees ranging from 0.75% - 1.38% per annum of net asset value of constituent funds under the Personal Account.

Special Voluntary Contributions Account and Tax Deductible Voluntary Contributions Account

Management fees of the constituent funds range from 0.75%-0.99% per annum of net asset value of constituent funds.

Retirees' Personal Accounts

For Personal Account members who have retired: 0.59% - 0.99% per annum of net asset value depending on constituent fund chosen under the Personal Account.

MPFA website: http://cplatform.mpfa.org.hk/MPFA/english/index.jsp

Members are becoming more and more involved in managing their MPF accounts, it is important to select the best fitted provider that provides quality service information to help you make appropriate investment decisions

How can BCT help? ReplayBCT strives to provide members with comprehensive and customer-centric solutions for managing their MPF account so that retirement planning can be convenient and straightforward

BCT’s member services are well-recognised within the industry.

Awards and RecognitionOur Investment Planning Service helps members gain a better understanding of their investment goals and risk levels in order to make informed investment decisions. This service does not only cover MPF investments but also other fund ranges such as Collective Investment Scheme (CIS). Through one-on-one consultations, members can find the most suitable funds based on their investment goals.

Learn moreOur Retirement Planning Service is aimed at assisting members to plan for retirement. Our experts will help members to get prepared for their retirement in financial, social as well as psychological aspects. Through this service, members will enjoy special management fee rates while being able to withdraw funds in phases.

Learn more